Crafting a Financial Strategy With Bookkeeping 8337071226

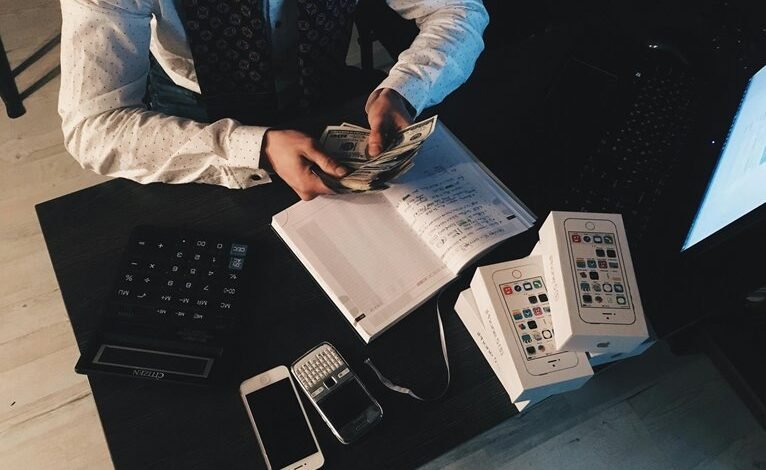

Crafting a financial strategy with effective bookkeeping is essential for organizations seeking sustainable growth. Accurate financial records provide insights into income and expenses, facilitating informed decision-making. This clarity aids in understanding financial health, which is vital for resource allocation. However, many businesses overlook the critical role of bookkeeping in optimizing cash flow and navigating uncertainties. Exploring these interconnected elements may reveal deeper strategies for enduring success.

Understanding the Importance of Bookkeeping in Financial Strategy

Effective financial strategy hinges on meticulous bookkeeping, which serves as the backbone of informed decision-making.

The bookkeeping benefits include enhanced financial accuracy, allowing organizations to track income and expenses with precision.

This clarity fosters a deeper understanding of financial health, empowering stakeholders to make strategic choices that align with their goals.

Ultimately, robust bookkeeping is essential for achieving sustainable financial freedom.

Key Components of a Financial Strategy

A comprehensive financial strategy comprises several key components that collectively guide an organization's fiscal health and growth.

Central to this framework are clearly defined financial goals and a thorough risk assessment, which together inform decision-making processes.

Establishing these elements enables organizations to navigate uncertainties, allocate resources efficiently, and ultimately achieve sustainable growth while maintaining the freedom to innovate and adapt in a dynamic marketplace.

Leveraging Bookkeeping for Informed Decision-Making

While organizations often prioritize high-level financial strategies, the role of bookkeeping in facilitating informed decision-making cannot be overlooked.

Accurate bookkeeping enables effective data analysis, providing critical insights into financial performance. These insights support financial forecasting, allowing organizations to anticipate trends and make strategic choices.

Optimizing Cash Flow Through Effective Bookkeeping Practices

Optimizing cash flow is essential for the sustainability and growth of any organization, and bookkeeping plays a pivotal role in achieving this objective.

Effective bookkeeping techniques, such as timely invoicing and diligent expense tracking, enhance cash flow management.

Conclusion

In the intricate tapestry of financial management, bookkeeping serves as both the loom and the thread, weaving together clarity and insight. By meticulously tracking each stitch—every income and expense—organizations can craft a resilient financial strategy that withstands the tests of time. This foundation not only illuminates the path for informed decision-making but also fortifies cash flow, allowing businesses to navigate uncertainties with confidence. Ultimately, effective bookkeeping transforms financial data into a roadmap for sustainable growth and innovation.